- SERVICES

- HIGHER EDUCATION MARKETING

- ENGAGEMENT & ENROLLMENT MANAGEMENT

- STUDENT RECRUITMENT AGENCIES

- PROFESSIONAL EDUCATION & TRAINING

- WHO WE ARE

WHO WE ARE

Learn more about Keystone Education Group, including our leadership structure, why choose Keystone as your educational partner, and company press releases.

QUICK LINKS

- RESOURCES

RESOURCES

Find a range of helpful resources to help with your educational marketing. From on-demand webinars, reports & data, to customer testimonials and our downloadable media kit.

QUICK LINKS

- NEWS

- REQUEST A CALL

- Keystone Higher Education News

- Recognising the Impact of Inflation on Students

A 40-year-high inflation in the US has impacted everything from fuel prices to electronics - to the cost of higher education.

According to the United States Labor Department, the annual inflation rate for the United States is 8.5% for the 12 months ended July 2022 after rising 9.1% previously — the most since 1981. College tuition has seen an annual inflation average of 4.63% from 2010 to 2020, and after adjusting for currency inflation, has increased 747.8% since 1963.

Many factors impact inflation, but the unprecedented global pandemic left the Federal Reserve and economists without a historical playback to know what to expect.

College students in the United States are resourceful but rightfully concerned about where their money is going on top of record student debt. And while the growing cost of higher education is commonly discussed in the news, the short-term challenge incoming college students face today extends to the daily cost of living.

Financial aid administrators, business school faculty, and student activity unions need to provide more financial literacy to current college students. Financial aid offices do an excellent job breaking down the cost of education before students enroll at the institution, but it can’t stop there. Colleges nationwide have a responsibility to provide proper guidance and support.

In our 2022 State of Student Recruitment survey, the number one concern for students was 'tuition fees and living expenses' with 81% voting it as the top concern.

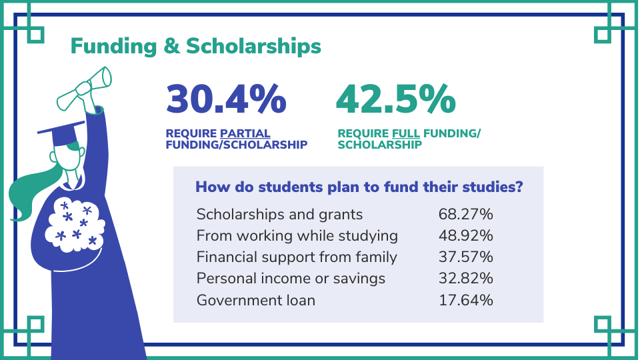

Other funding data from the report:

The good news is college students are skilled at the art of budgeting money. However, here are some ideas that institutions could implement on campus to help students save money in the day-to-day.

- Book rental programs - save students thousands of dollars compared to buying the assigned reading material for classes.

- Transportation is another factor to consider during this historic inflation. Does your institution offer access to student shuttle services? What are the various methods students get to campus for class? Is there a way to discount parking permits? How can your commuter students create a ride-share program? While students in rural settings may require a car to get to and from campus, urban campuses must work with outside companies and find public transportation discounts for students.

- Offer free events on campus - Student Unions can offer free events on campus, especially over holiday periods when not all students are able to travel home.

- Flexible learning - While some students enjoy being back on campus full-time, there are now more students than ever taking classes online.

Because getting to campus, purchasing a meal plan, living in a dorm room, and missing work because of a college class schedule all cost money. For a certain population (particularly graduate students), having a hybrid learning model is more cost and time effective. College may still charge the same tuition but discount the program fees based on facility usage vs. virtual learning.

Students can study towards the same degree while saving money and spending more time gaining real-world experience in the job market as a student.

There are also negatives associated with online learning, however. The overnight transformation of the lockdowns impacted students dramatically and considering the number of class-action lawsuits filed against various institutions around the country, it is clear that students didn’t feel they paid for what was delivered.

Advice to share with students - taking advantage of the perks

From retail and transportation to electronics and entertainment, obtaining a .edu account as a college student has its perks. Most institutions offer some form of free computer usage on campus, but for many students, a laptop or tablet is needed in this generation.

Examples:

- Adobe, Apple, Samsung, HP, and Microsoft offer various student deals throughout the year. For cellphone plans, AT&T and Verizon offer savings up to $25/month for eligible students.

- AMC Theaters offer discounted tickets with a valid student ID. Major League Baseball works with hundreds of college campuses to sell discounted group rate tickets. And some of the country’s most prominent museums and art exhibits are substantially discounted or free for college students.

- Amtrak, General Motors, Penske, Trailways, and the MTA Subway or buses in NYC offer discount rates for college students.

- One of the best ways to save money in our current environment is to cancel unnecessary memberships and subscriptions. Sure, some college residence halls provide free cable, but with WIFI as accessible as ever in 2022, students need their hourly fix of steaming services and to know what happens during the series finale of Netflix’s Stranger Things.

- Spotify, Apple TV, Amazon Prime, Peloton, Audible, YouTube Premium, the New York Times, and the Wall Street Journal all offer significant discounts to college students.

- Learn more by visiting college student discount sites like UNiDAYS, Student Beans, or Student Discount.

More about:

Related Tags

Just For You

Top Picks

Higher Ed Chats Podcast

Listen to the latest episodes of our Higher Ed Chats Podcast. Hear from Higher Ed thought-leaders from around the world!

The Keystone Awards 2026:

Nominate your institution or a student

Recognize your your university, team, colleagues and students for a Keystone Award!

Subscribe

to get the latest news and updates